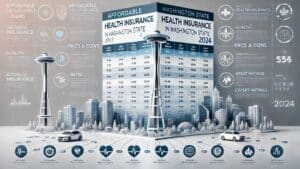

In the realm of health insurance, Kaiser Permanente stands out as a unique entity, blending the roles of insurer and healthcare provider. Established in 1945, Kaiser Permanente has grown to become one of the largest and most integrated health systems in the United States. In 2024, the organization continues to attract attention for its comprehensive approach to healthcare, emphasizing preventive care and patient satisfaction. This review delves into the pros and cons of Kaiser Permanente’s health insurance offerings and examines both expert and user ratings.

Overview of Kaiser Permanente

Kaiser Permanente operates across several states, including California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, Washington, and the District of Columbia. The organization consists of three components: the Kaiser Foundation Health Plan, Kaiser Foundation Hospitals, and the Permanente Medical Groups. This structure allows Kaiser Permanente to provide a seamless healthcare experience, from insurance coverage to medical care delivery.

Pros of Kaiser Permanente Health Insurance

1. Integrated Healthcare System

One of the most significant advantages of Kaiser Permanente is its integrated healthcare system. Members benefit from a coordinated approach where their health insurance plan and healthcare providers are part of the same organization. This integration ensures better communication between doctors, streamlined medical records, and more efficient care delivery.

2. Emphasis on Preventive Care

Kaiser Permanente places a strong emphasis on preventive care. The organization encourages regular check-ups, screenings, and vaccinations to detect and manage health issues early. Members often receive reminders for necessary preventive services, contributing to better long-term health outcomes.

3. High-Quality Care

Kaiser Permanente is renowned for its high-quality care. The organization consistently ranks highly in various healthcare quality metrics, including patient satisfaction, clinical outcomes, and preventive care measures. Its focus on evidence-based medicine and continuous improvement ensures that members receive top-notch care.

4. Comprehensive Coverage Options

Kaiser Permanente offers a wide range of health insurance plans, including HMO (Health Maintenance Organization) plans, Medicare Advantage plans, and employer-sponsored plans. These plans often include comprehensive coverage for medical, dental, and vision care, making it easier for members to access the services they need.

5. Convenient Access to Care

With numerous medical facilities and pharmacies, Kaiser Permanente members enjoy convenient access to care. The organization also offers robust telehealth services, allowing members to consult with healthcare providers remotely, schedule appointments online, and access their medical records through a user-friendly app.

Cons of Kaiser Permanente Health Insurance

1. Limited Service Area

One of the main drawbacks of Kaiser Permanente is its limited service area. While it operates in several states, it is not available nationwide. Individuals living outside the service areas cannot access Kaiser Permanente plans, limiting their choices.

2. Network Restrictions

Kaiser Permanente operates as an HMO, meaning members must use the organization’s network of providers and facilities for their healthcare needs. While the network is extensive, it can be restrictive for those who prefer to see out-of-network providers or specialists.

3. Higher Premiums

In some regions, Kaiser Permanente’s premiums can be higher than those of other insurers. Although the comprehensive coverage and quality of care may justify the cost, it can be a significant factor for price-sensitive individuals and families.

4. Mixed Reviews on Customer Service

While many members report positive experiences with Kaiser Permanente’s customer service, there are also complaints about long wait times, billing issues, and difficulties in accessing specific services. Customer service experiences can vary widely depending on the region and individual circumstances.

Expert Ratings

Experts in the healthcare industry generally view Kaiser Permanente favorably. The organization often receives high marks for its quality of care, preventive services, and integrated healthcare model. In the annual rankings by U.S. News & World Report, Kaiser Permanente’s plans frequently appear among the top-rated health insurance options.

User Ratings

User ratings for Kaiser Permanente are mixed, reflecting both positive and negative experiences. On popular review platforms such as Yelp and Consumer Affairs, members praise the ease of accessing care, the quality of healthcare providers, and the emphasis on preventive services. However, some users express frustration with customer service, network restrictions, and the cost of premiums.

To make long-story short

Kaiser Permanente continues to be a significant player in the health insurance market in 2024, offering a unique and integrated approach to healthcare. The organization’s strengths lie in its high-quality care, preventive focus, and comprehensive coverage options. However, potential members should consider the limitations of the service area, network restrictions, and potential higher premiums. By weighing the pros and cons and reviewing both expert and user ratings, individuals can make an informed decision about whether Kaiser Permanente is the right health insurance provider for their needs.