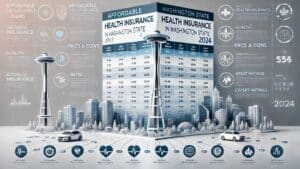

Finding affordable health insurance can be a challenging task, especially for single males who might not need extensive family coverage. In 2024, the health insurance landscape offers various plans tailored to meet the needs of single individuals, providing essential benefits without breaking the bank. Here, we will explore some of the top health insurance companies offering affordable options for single males, including their pros and cons, as well as expert and consumer ratings.

1. Blue Cross Blue Shield

Pros:

- Extensive network of providers

- Variety of plan options

- Strong customer service

Cons:

- Higher premiums in some regions

- Complex plan structures can be confusing

Expert Rating: 4.5/5

Consumer Rating: 4.3/5

Blue Cross Blue Shield (BCBS) is known for its comprehensive coverage and wide network of healthcare providers. Single males can benefit from the variety of plan options that cater to different health needs and financial situations. However, some plans may have higher premiums depending on the region, and the complexity of the plans might require careful consideration.

2. UnitedHealthcare

Pros:

- Large provider network

- Excellent telehealth services

- Wellness programs and discounts

Cons:

- Higher deductibles for lower premium plans

- Some plans have limited out-of-network coverage

Expert Rating: 4.4/5

Consumer Rating: 4.2/5

UnitedHealthcare offers robust telehealth services and a broad provider network, making it a great option for single males who value convenience and accessibility. The wellness programs and discounts can also help maintain a healthy lifestyle. However, the trade-off for lower premium plans is often higher deductibles and limited out-of-network coverage.

3. Kaiser Permanente

Pros:

- Integrated healthcare system

- High-quality care

- Preventive care focus

Cons:

- Limited to regions where Kaiser operates

- Requires using Kaiser facilities and doctors

Expert Rating: 4.6/5

Consumer Rating: 4.4/5

Kaiser Permanente is renowned for its integrated healthcare system, ensuring that all services from doctors to pharmacy are under one roof. This model often results in high-quality and coordinated care, with a strong emphasis on preventive services. However, it is only available in certain regions, and members must use Kaiser facilities and doctors, which might be restrictive for some.

4. Aetna

Pros:

- Affordable plan options

- Comprehensive preventive care

- Good customer support

Cons:

- Limited coverage in some rural areas

- Some plans have narrow networks

Expert Rating: 4.3/5

Consumer Rating: 4.1/5

Aetna offers several affordable health insurance plans that emphasize preventive care and customer support. These plans can be especially beneficial for single males looking to manage their health proactively. However, coverage might be limited in rural areas, and some plans come with narrow networks.

5. Cigna

Pros:

- Global coverage options

- Extensive wellness programs

- Flexible plan options

Cons:

- Higher costs for some plans

- Customer service can be inconsistent

Expert Rating: 4.2/5

Consumer Rating: 4.0/5

Cigna’s health insurance plans offer flexibility and a range of wellness programs that cater to the needs of single males. The global coverage option is particularly advantageous for those who travel frequently. While the flexibility and extensive programs are a plus, some plans can be more expensive, and customer service experiences vary.

6. Humana

Pros:

- Affordable premiums

- Emphasis on preventive care

- Excellent customer service

Cons:

- Limited availability in some states

- Higher out-of-pocket costs for certain plans

Expert Rating: 4.1/5

Consumer Rating: 3.9/5

Humana is known for its affordable premiums and strong customer service. Their emphasis on preventive care makes it a good choice for single males who prioritize maintaining their health. However, Humana’s availability is limited in some states, and certain plans come with higher out-of-pocket costs.

Summary

When searching for affordable health insurance options in 2024, single males have a variety of plans to choose from, each with its unique benefits and drawbacks. It is essential to evaluate each option based on individual health needs, financial situation, and personal preferences. Consulting with an insurance advisor and carefully comparing plans can help in making an informed decision to secure the best possible coverage.

By considering the pros and cons of top insurance providers like Blue Cross Blue Shield, UnitedHealthcare, Kaiser Permanente, Aetna, Cigna, and Humana, single males can find a plan that balances affordability with comprehensive care.