The U.S. Property/Casualty Insurance Industry: A 2024 Financial Overview

The U.S. property and casualty (P/C) insurance industry faced another challenging year in 2024, yet the financial landscape showed signs of improvement. According to a recent report by AM Best, the industry experienced an underwriting loss of $2.6 billion in 2024, a significant recovery from the staggering $24.6 billion loss recorded in 2023. This shift can be attributed to strategic rate increases and enhanced risk selection practices.

Improved Underwriting Results

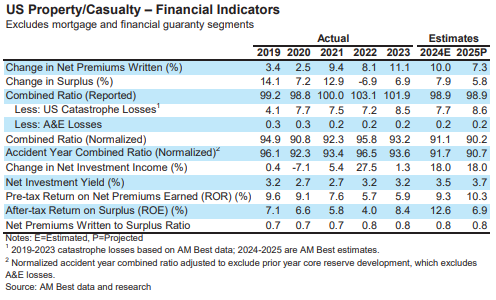

The estimated combined ratio for the P/C industry in 2024 was 98.9, a notable improvement from the previous year’s combined ratio of 101.9. A lower combined ratio indicates better profitability, as it reflects the percentage of premiums used to pay claims and expenses. The industry’s resilience suggests a potential turnaround, with expectations for continued improvement in the coming years.

Personal Lines Segment Drives Recovery

The personal lines segment of the insurance market played a pivotal role in this turnaround. In 2024, personal lines reported a net underwriting loss of $11.9 billion, a substantial reduction from the $36.7 billion loss in 2023. Key contributors to this improvement were rate hikes in auto and homeowners insurance. The combined ratio for auto insurance improved to 98.7 from 104.9, while homeowners insurance saw a reduction from 110.9 to 105.7.

AM Best noted that personal lines premiums surged by 12.9% in 2024, with projections indicating a 9% increase for 2025. Insurers are now focusing on achieving necessary rate increases to meet their calculated rate needs, particularly for private passenger auto and homeowners multiperil coverage. The industry is prepared to withdraw from states where these increases are not approved, highlighting the critical nature of rate adequacy.

Future Outlook for the Industry

Looking ahead to 2025, AM Best anticipates that the P/C industry will build on its solid recovery, despite potential challenges from secondary peril losses and adverse litigation trends, such as social inflation and third-party litigation funding. The personal auto insurance line, which constitutes a significant portion of the industry’s direct premium, is expected to continue its positive trajectory, with a predicted reduction in the combined ratio to 97.5.

While the homeowners segment is still projected to incur slight underwriting losses in 2025, the overall results from personal auto insurance will have a considerable impact on the industry’s financial health.

Commercial Lines Performance

The commercial lines segment outperformed personal lines in 2024, achieving a combined ratio of 97. However, challenges persist, particularly in commercial auto insurance, which recorded a combined ratio of 108.5. AM Best has expressed a negative outlook for commercial auto, general liability, and directors and officers (D&O) insurance.

Commercial lines net premiums increased by 6.1% in 2024, a decrease from the 8.1% growth in 2023, reflecting ongoing price declines in workers’ compensation and certain specialty casualty lines. For 2025, growth is expected to slow to approximately 4%, with the combined ratio remaining stable at 97.

Key Takeaways

The U.S. property/casualty insurance industry has shown resilience in 2024, with significant improvements in underwriting losses and combined ratios. The personal lines segment, driven by strategic rate increases, has been instrumental in this recovery. As the industry looks forward to 2025, it must navigate challenges while capitalizing on the momentum gained in recent years.

For further insights into the insurance industry’s performance and trends, you can refer to AM Best’s detailed reports on insurance market trends.

In essence, while the U.S. P/C insurance industry has faced considerable challenges, the signs of recovery and strategic changes in underwriting practices offer a hopeful outlook for the future.