Home insurance is essential for protecting your property and belongings from unexpected events. While it’s designed to provide peace of mind, filing a claim can be a hassle and may lead to increased premiums. Understanding the most common home insurance claims and how to avoid them can help you maintain a safe home and potentially save money on your insurance.

1. Water Damage and Freezing

Common Claims:

- Burst pipes

- Leaking roofs

- Appliance leaks

- Flooding from heavy rains

Prevention Tips:

- Regularly inspect and maintain your plumbing system.

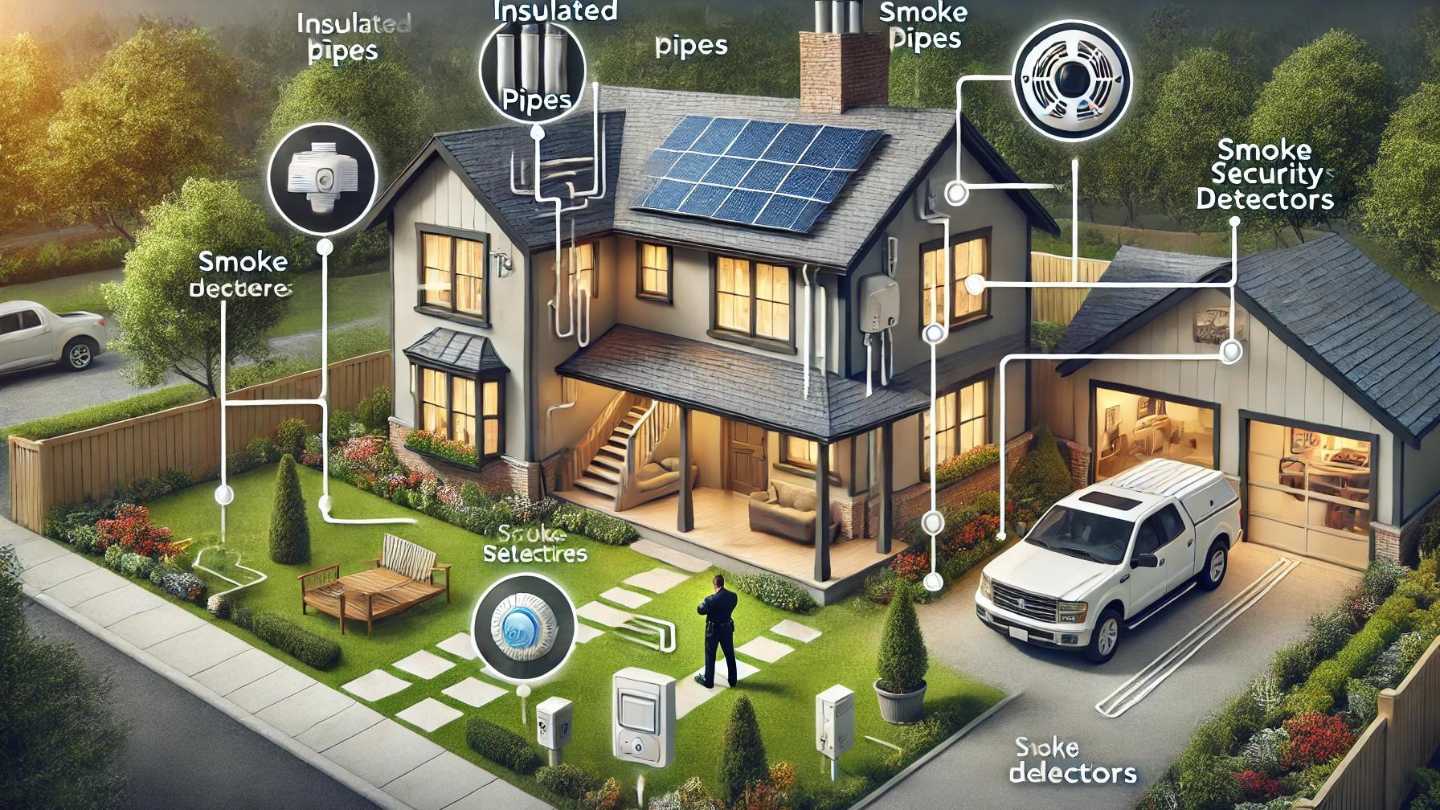

- Insulate exposed pipes to prevent freezing.

- Keep your roof in good repair and clear of debris.

- Install water detection devices near appliances that use water.

- Ensure proper drainage around your home to prevent flooding.

2. Wind and Hail Damage

Common Claims:

- Roof damage

- Broken windows

- Siding damage

Prevention Tips:

- Install impact-resistant roofing materials and windows.

- Trim trees and branches near your home.

- Secure outdoor furniture and other objects that could become projectiles.

- Regularly inspect your roof and repair any damage immediately.

3. Fire and Smoke Damage

Common Claims:

- Kitchen fires

- Electrical fires

- Wildfires

Prevention Tips:

- Install smoke detectors in every room and test them regularly.

- Keep fire extinguishers readily accessible.

- Avoid overloading electrical outlets and replace damaged cords.

- Create a defensible space around your home by clearing away flammable vegetation.

4. Theft and Vandalism

Common Claims:

- Stolen property

- Damaged property due to break-ins

Prevention Tips:

- Install a home security system with cameras and alarms.

- Keep doors and windows locked, even when you’re home.

- Use motion-sensor lighting around your property.

- Avoid advertising expensive purchases or vacations on social media.

5. Liability Claims

Common Claims:

- Injuries to guests on your property

- Dog bites

Prevention Tips:

- Maintain walkways and remove tripping hazards.

- Ensure your home and yard are well-lit.

- Secure pets in a safe area when guests are present.

- Purchase an umbrella insurance policy for additional liability coverage.

6. Weather-Related Damage

Common Claims:

- Flooding

- Earthquake damage

Prevention Tips:

- Consider purchasing separate flood and earthquake insurance if you live in high-risk areas.

- Elevate your home’s foundation and install sump pumps in basements.

- Retrofit your home to withstand earthquakes.

Final Thoughts

By understanding the most common home insurance claims and taking proactive steps to prevent them, you can protect your home and reduce the likelihood of filing a claim. Regular maintenance, investing in safety features, and being prepared for emergencies can make a significant difference in safeguarding your property. Additionally, taking these measures may help you secure lower insurance premiums, providing both financial and emotional peace of mind.