Insurance is designed to offer protection and peace of mind, but unfortunately, it also attracts fraudsters looking to exploit the system. Here are the top 10 insurance scams in the United States that you should be aware of:

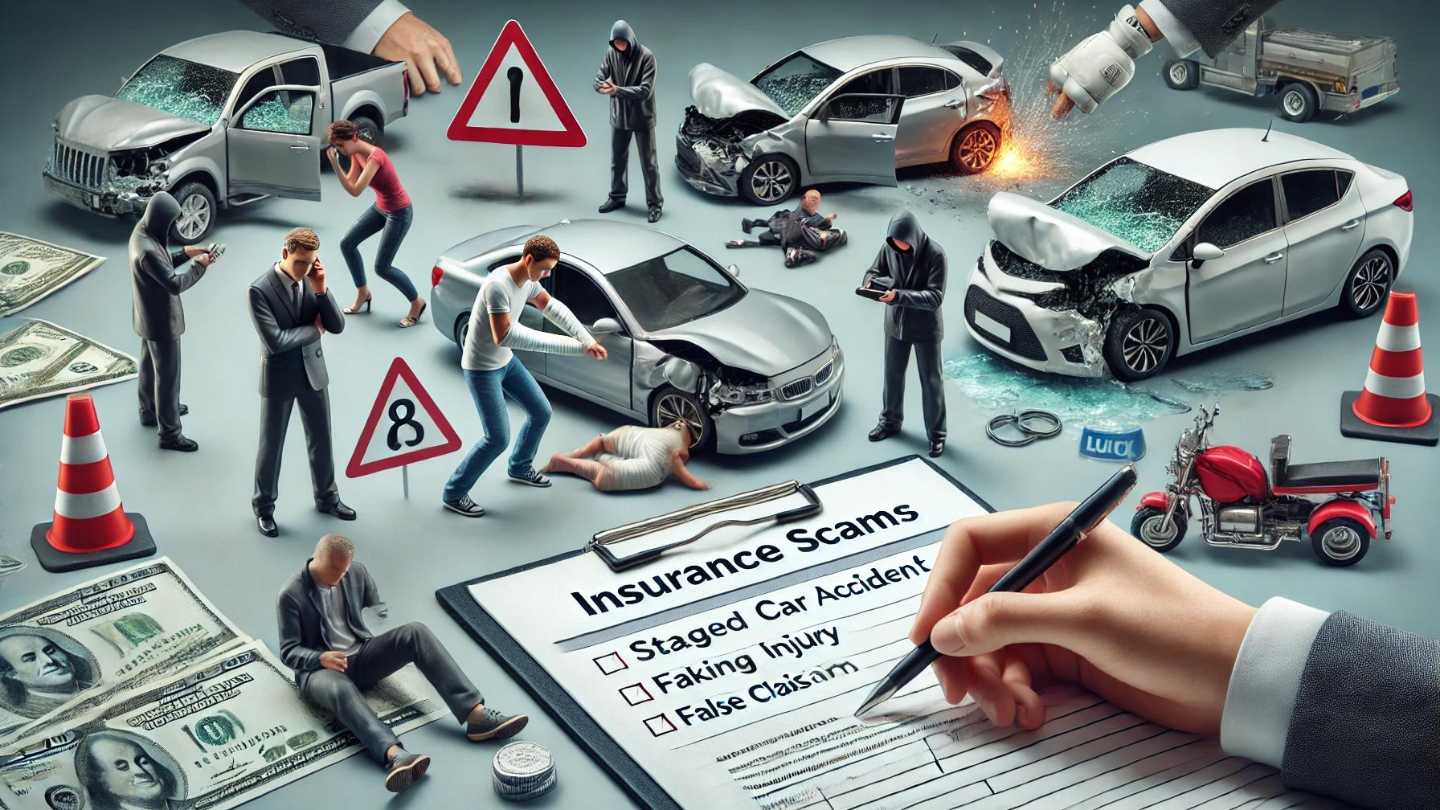

1. Staged Auto Accidents

Fraudsters deliberately cause accidents or stage collisions to file bogus claims for vehicle damage and medical expenses. These scams often involve multiple parties working together to make the accident appear legitimate.

Example: John and his accomplice arrange a minor collision at a busy intersection. They claim the other driver was at fault and file for vehicle damages and medical expenses. The scam involves fabricated witness statements and exaggerated injury claims.

2. Fake Injury Claims

Individuals might fake or exaggerate injuries to collect insurance payouts. This can occur in various contexts, including workplace injuries, slip-and-fall incidents, or car accidents.

Example: Lisa slips on a wet floor at a grocery store but wasn’t seriously hurt. However, she pretends to have severe back pain and files a claim for extensive medical treatment and lost wages, despite being able to continue her daily activities.

3. Ghost Broker Scams

Ghost brokers sell fake insurance policies to unsuspecting customers, often at a significant discount. The victim only discovers the fraud when they try to file a claim or are pulled over for having invalid insurance.

Example: Michael advertises cheap car insurance online. Jane buys a policy from him, but when she gets into an accident, she discovers that her policy is fake and she is not covered. Michael has vanished with her money.

4. Premium Diversion

In this scam, an insurance agent or broker takes premium payments from policyholders but does not forward the money to the insurance company. The agent keeps the money, and the policyholder is left without coverage.

Example: Susan, an insurance agent, collects premiums from clients but instead of forwarding them to the insurance company, she pockets the money. When a client files a claim, they find out their policy was never active.

5. False Claim Filing

This involves submitting claims for damages or losses that never occurred. Fraudsters might invent incidents like home burglaries, fires, or car accidents to collect insurance money.

Example: Mark claims his house was burglarized and submits an inventory of stolen items, including expensive electronics and jewelry. In reality, no burglary occurred, and he fabricated the list to receive a hefty insurance payout.

6. Healthcare Fraud

Healthcare providers, including doctors and clinics, might bill insurance companies for services that were never rendered or overbill for treatments. This inflates the cost of healthcare for everyone.

Example: Dr. Smith bills an insurance company for procedures and tests that were never performed on patients. He submits inflated claims for simple treatments, increasing his reimbursements illegally.

7. Life Insurance Fraud

Beneficiaries might fake the policyholder’s death to collect life insurance benefits. In some cases, the policyholder might disappear or fake their own death.

Example: Tom takes out a life insurance policy and then fakes his own death with the help of a friend. His wife, unaware of the scheme, files a claim and collects the benefits, only to discover the truth when Tom is found alive years later.

8. Inflated Home Repair Claims

Contractors might inflate repair costs or even create additional damage to file larger claims with the homeowner’s insurance. This can include unnecessary repairs or billing for work that was never done.

Example: After a minor storm, contractor Bob convinces homeowners that their roof needs complete replacement. He inflates the cost and bills the insurance company for unnecessary repairs, pocketing the excess money.

9. Worker’s Compensation Fraud

Employees might fake injuries or continue to claim benefits after they have recovered. Employers might also commit fraud by misclassifying employees to pay lower premiums.

Example: Emily, an employee at a warehouse, claims she injured her back lifting boxes. She continues to collect workers’ compensation benefits even after she has fully recovered and is secretly working another job.

10. Identity Theft Insurance Fraud

Scammers steal someone’s identity to purchase insurance policies and then file claims in the victim’s name. This type of fraud can severely damage the victim’s credit and financial standing.

Example: Rachel’s identity is stolen, and the thief buys several insurance policies in her name. The fraudster files false claims and collects the payouts, leaving Rachel to deal with the fallout and damaged credit.

How to Protect Yourself

To safeguard against these scams, always verify the legitimacy of any insurance agent or broker. Be cautious of deals that seem too good to be true, and always report suspicious activities to the authorities. Regularly review your insurance policies and statements to ensure all details are correct and no unauthorized changes have been made.

By staying informed and vigilant, you can protect yourself from falling victim to these common insurance scams.

Related Articles:

- Insurance Fraud Prevention Tips – AttorneyGeneral.gov

- Avoiding Health Insurance Scams – Mass.gov

- Avoiding Scams and Scammers – FDIC.gov